Financial and stock research sites like Yahoo Finance, Google Finance, Marketwatch, or CNNMoney have done a lot to democratize investment research by bringing reams of financial data for any publicly traded company to investors at the click of a button. But when it comes to financial metrics, much of the data they provide is the same for every company: revenues, earnings, PE ratios, market caps, assets, liabilities, analyst estimates, and so on. To really understand a company, this data is just a starting point. By the end of next week, Wikinvest is planning on introducing a new feature to help investors dig deeper. Says co-founder Michael Sha:

Financial and stock research sites like Yahoo Finance, Google Finance, Marketwatch, or CNNMoney have done a lot to democratize investment research by bringing reams of financial data for any publicly traded company to investors at the click of a button. But when it comes to financial metrics, much of the data they provide is the same for every company: revenues, earnings, PE ratios, market caps, assets, liabilities, analyst estimates, and so on. To really understand a company, this data is just a starting point. By the end of next week, Wikinvest is planning on introducing a new feature to help investors dig deeper. Says co-founder Michael Sha:

People have a thirst for information and data, but the traditional data available does not make much logical sense. They don’t help you understand the nuances of companies and industries.

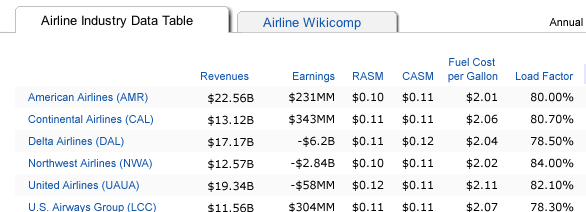

Each industry has its own unique set of comparable metrics by which analysts and professional investors gauge the health and productivity of the companies in that industry. For airlines, it might be fuel costs, revenue per available seat-mile, cost per available seat-mile, and load factors (what percentage of seats are sold per flight). For home builders, the comps might be number of home closings, number of new contracts, and number of canceled contracts. For manufacturers, you might want to look at inventory turns. For banks, default rates and interest rate spreads. It is too much for any one individual investor to calculate and keep track of.

But that is where Wikinvest comes in. As the name suggests, the site is like Wikipedia for stock research, and is part of a growing trend of investment sites that tap into the wisdom of the crowd for investment advice. (See also, Cake Financial, Covester, and Motley Fool CAPS). All it takes is for one member to add a useful piece of data for everyone else to benefit from it. The company will seed about a dozen industries with comp data, and then invite its members to fill out the rest. Each data point must be footnoted with a source.

This is a really powerful example of what can happen when people collaborate around data. The comp numbers will appear on each industry page, relevant company pages, and a metrics page for each metric. They will also be embedded within articles about specific companies or industries. Explains Wikinvest’s other co-founder Parker Conrad:

What we are building is wiki for data. You might have data on our site that appears in multiple points on the site and that data point is updated everywhere it appears.

That’s great if the data is right. But there is one caveat: errors will also propagate more widely as a result. Wikis are eventually self-correcting by nature, but tell that to the investor who takes an erroneous piece of data on faith in the middle of an edit war and buys or sells a stock because of it.