JPMorgan’s Internet analyst Imran Khan and his team released a massive 312-page report this morning titled Nothing But Net that paints a bullish picture for the major Internet stocks (Google, Amazon, Yahoo, eBay, Expedia, Salesforce.com, Ominiture, ValueClick, Monster.com, Orbitz, Priceline, CNET, etc.). Some key takeaways:

—Noting that, in 2007, Internet stocks delivered a 14 percent return versus 5 percent for the S&P 500, JPMorgan expects 34 percent earnings growth in 2008 for the Internet stocks it covers versus 8 percent earnings growth for the S&P 500.

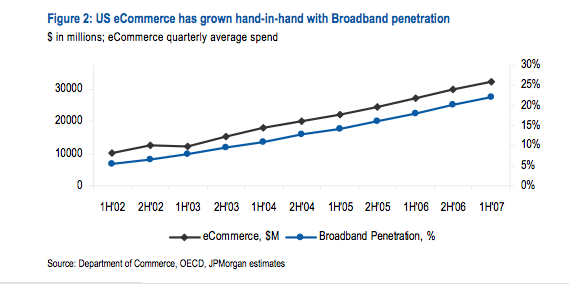

—In general, as broadband penetration continues to rise, so do e-commerce revenues:

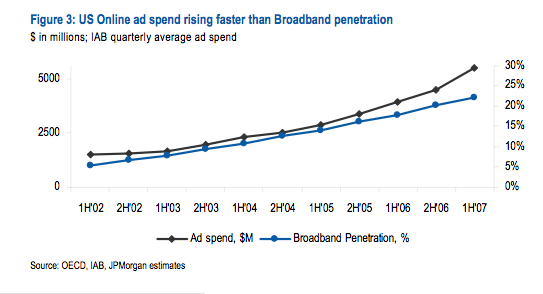

—But advertising revenues actually outpace the adoption of broadband:

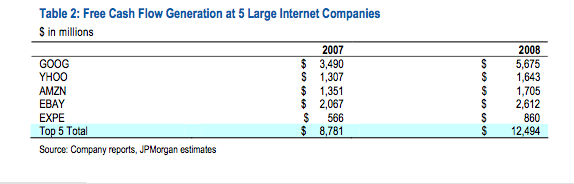

—Free cash flow at large Internet companies will keep going up, fueling M&A and share buybacks. JPMorgan estimates that free cash flow among just five of the top Internet companies (Google, Yahoo, Amazon, eBay, and Expedia) will rise from $8.8 billion last year to $12.5 billion in 2008. That is a lot of money for Web 2.0 acquisitions. Top acquirers Yahoo and Google, for instance, each spend about a third of their free cash flow on acquisitions.

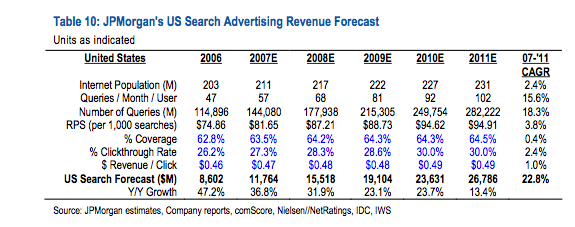

—Search advertising will continue to dominate, rising from $22 billion globally last year to $50 billion in 2010. Here is JPMorgan’s forecast for the U.S. search advertising market (it expects global search revenues to rise 38 percent in 2008 to $30.5 billion):

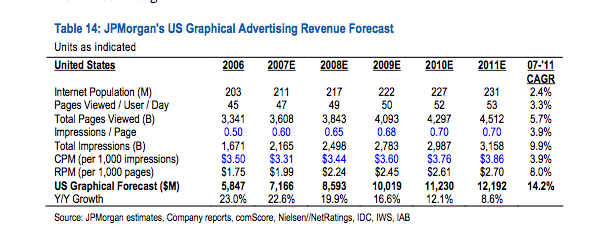

—And here is its forecast for the U.S. graphical advertising market. Average CPMs for online ads, which bottomed in 2007 at $3.31, will start to rise again (see table below):

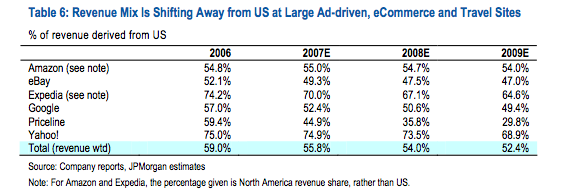

—As global GDP continues to grow faster than U.S. GDP (3.9 percent versus 2.2 percent in 2007), Internet companies with global reach will benefit. Amazon, eBay, and Google all get about half their revenues from international markets. Yahoo gets only a quarter of its revenues from abroad.