Holiday shopping season starts today, but chances are that you are going to end up with a bunch of gift cards this year that you may never end up using. Gift cards are expected to be the most widely-given gift this year, with 69 percent of consumers planning to buy them according to one survey. The annual value of gift cards in the U.S. is estimated to reach $100 billion next year, and about 27 percent of people who get a gift card still have not redeemed it one year later. That came to $8 billion in unredeemed money in 2006.

Holiday shopping season starts today, but chances are that you are going to end up with a bunch of gift cards this year that you may never end up using. Gift cards are expected to be the most widely-given gift this year, with 69 percent of consumers planning to buy them according to one survey. The annual value of gift cards in the U.S. is estimated to reach $100 billion next year, and about 27 percent of people who get a gift card still have not redeemed it one year later. That came to $8 billion in unredeemed money in 2006.

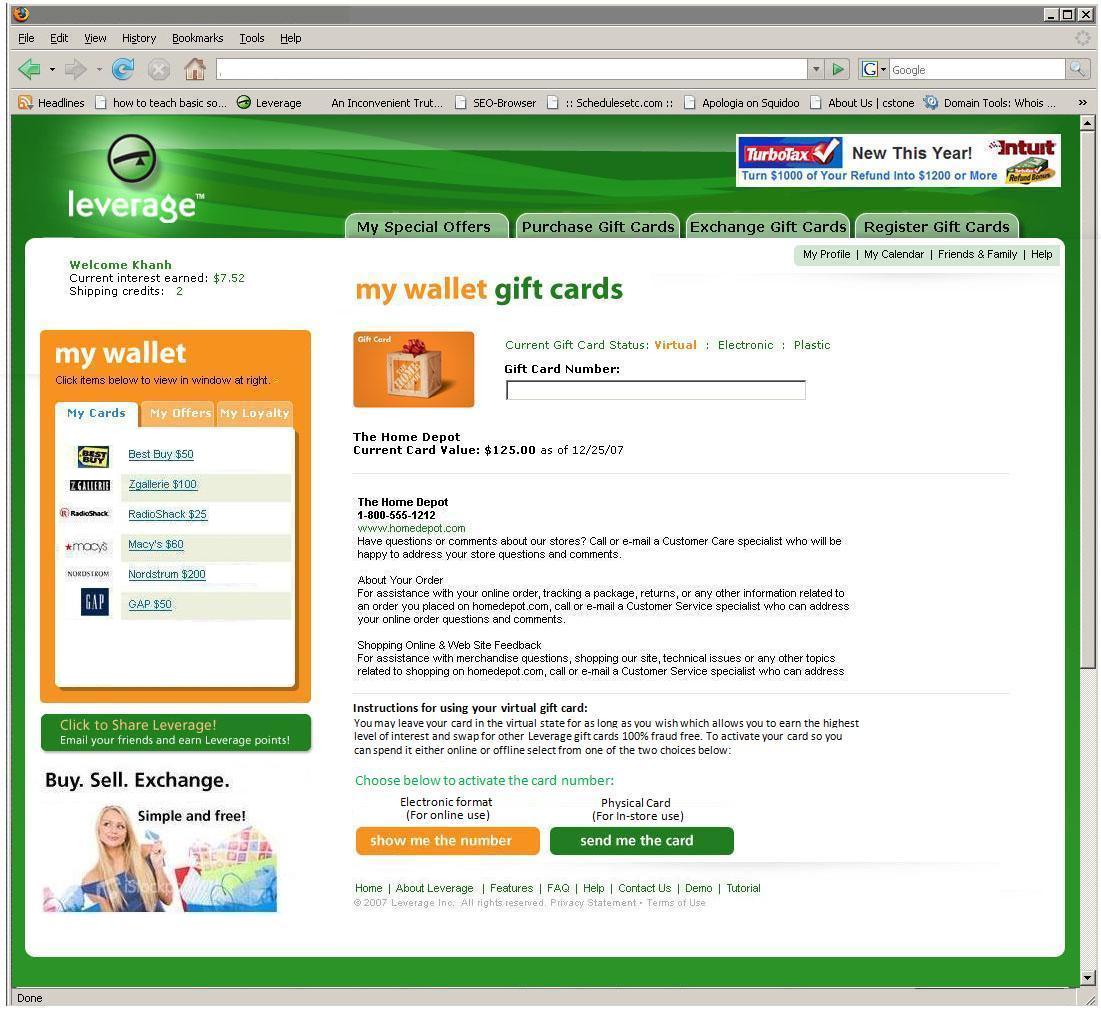

Gift cards are a big, inefficient business. A new startup called Leverage wants to help you manage all of those gift cards with a service it is launching next week (probably on Thursday). On Leverage, you will be able to register all of your gift cards and keep track of how much you have left or stored on each one. You will also be able to buy gift cards, or swap them with others (like Swapagift). The site will also let you manage all of your loyalty reward programs, such as frequent-flyer or frequent-stay plans. To get people to register cards on the site, it will pay “interest” on the value stored on the cards (3.2 percent for cards bought through the site, and about 1 percent for cards bought elsewhere). Leverage is not really paying interest, since it does not hold the money. It is a marketing gimmick—i.e., the nominal money it will pay out will be treated as a customer acquisition cost.

Leverage, which was founded in May 2005 and has raised $2 million in angel funding, plans to make a little money by reselling those gift cards. But its main source of income will be through lead generation and data analytics. Most retailers have no idea who ends up getting their gift cards. As more people sign up for Leverage, it can tell those retailers the demographics of the people who hold their cards in an aggregated, anonymous way. (“We will never reveal personally identifiable information,” promises CEO Mark Edwards Roberts). The real opportunity for Leverage, though, will be in ads targeted at people who already hold a cash incentive to shop at a particular store. For most people, a gift card is really just a coupon—53 percent end up spending more than the amount on the card. Leverage will know who holds cards for which retailers and will be able to send targeted messages to them on behalf of those retailers. But the targeting is transparent. Leverage members will also get to see exactly how they are being targeted—”Male 25-60 ears old, living in CA”.

Leverage, which was founded in May 2005 and has raised $2 million in angel funding, plans to make a little money by reselling those gift cards. But its main source of income will be through lead generation and data analytics. Most retailers have no idea who ends up getting their gift cards. As more people sign up for Leverage, it can tell those retailers the demographics of the people who hold their cards in an aggregated, anonymous way. (“We will never reveal personally identifiable information,” promises CEO Mark Edwards Roberts). The real opportunity for Leverage, though, will be in ads targeted at people who already hold a cash incentive to shop at a particular store. For most people, a gift card is really just a coupon—53 percent end up spending more than the amount on the card. Leverage will know who holds cards for which retailers and will be able to send targeted messages to them on behalf of those retailers. But the targeting is transparent. Leverage members will also get to see exactly how they are being targeted—”Male 25-60 ears old, living in CA”.

What’s in it for consumers? They can avoid getting all of those marketing e-mails to their in-box (messages appear only when they log into their Leverage account) and they can control how often they want to receive messages from any particular retailer. And they can have a single dashboard to manage all of those gift cards and loyalty programs. Still, if I can’t even be bothered to put those gift cards in my wallet (I’m one of those 27 percent who let my gift cards languish), I am not going to take the time to enter each one onto a Website. I can see this service being useful if you get a lot of gift cards, and need to keep track of more than five or six. What would make it more appealing is if you got an actual Leverage card that acted as an uber-gift card. You know, One Card to Rule Them All. The way that could work is that the card is tied to your online Leverage account, which knows all your balances. You take it to Best Buy, it taps into the $50 in your gift card account. You take it to Macy’s, and it sees you have $75. The startup is working on just such a card.