TuitionCoach attempts to give parents a clear idea of just how much their kids’ college will cost them. When I got a demo that estimated what it could cost to pay for one offspring’s education out-of-pocket, I rethought my desire to ever have kids.

TuitionCoach attempts to give parents a clear idea of just how much their kids’ college will cost them. When I got a demo that estimated what it could cost to pay for one offspring’s education out-of-pocket, I rethought my desire to ever have kids.

TuitionCoach launches tomorrow. It is geared towards parents of teenagers who might be putting kids in university within the next year or two. What it lacks is financial planning and savings help. It tells you how much college will cost, how much financial aid you can get, and how to negotiate for more. But it doesn’t tell you how to save. If your kids are in grade school, what is the best way to put away? Should you contribute to an IRA or a 401K? This is not the site to find that info, although the CEO Monisha Perkash hopes it eventually will be.

“Right now with our module, it’s more targeted for kids that are in high school already so you’re thinking one to four years out but what we do plan to do in our future modules is provide tools that help you in starting to plan when your kids are 8 or 9 or 10,” Perkash said in a phone conversation on Monday.

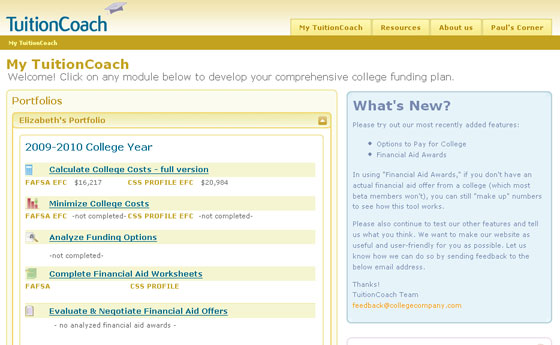

TuitionCoach allows you to create separate profiles for each child that you plan to put through school. The most helpful part is the interactive spreadsheet. The numbers can be manipulated easily in order to figure out how to qualify for the most amount of aid. For example, what if your child has a savings account in his/her name worth $10,000? That could reduce your family’s financial aid eligibility by 35 percent. Changing that number to zero, decreases your financial responsibility by $3,500 per year.

Perkash compares the TuitionCoach service to Intuit’s TurboTax in that it is a paid-service that makes it easier to do something that you could do yourself. The cost calculator is free but the financial aid help and worksheets come with an annual $59 subscription.